Pet Insurance Deductibles Explained

Just like your pup's obsession with chasing their tail or your cat's knack for squeezing into impossibly small boxes, the world of pet insurance can sometimes leave you feeling a little puzzled.

But fret not, because we're here to demystify the fur-ocious world of pet insurance deductibles, and we promise it won't be as "ruff" as it sounds!

So, sit, stay, and get ready because we are diving into the ins and outs of pet insurance deductibles.

Table of Contents

- What is a Pet Insurance Deductible?

- How Pet Insurance Deductibles Work

- What is a Typical Deductible for Pet Insurance?

- Why Opt for a Smaller (or Larger) Deductible?

- Choosing the Right Pet Insurance Deductible for You

- Types of Pet Insurance Deductibles

- Deductibles vs. Reimbursement Percentage

- Do All Claims Apply to a Pet Insurance Deductible?

- Are There Pet Insurance Policies with No Deductible?

- Explore Flexible Pet Insurance Deductibles with Furkin

What is a Pet Insurance Deductible?

How Pet Insurance Deductibles Work

Whether you are getting started with pet insurance for the first time or are switching to a new provider, choosing your deductible amount is one of the first steps in picking your policy.

Here’s how pet insurance deductibles work, in a nutshell:

- You choose your deductible: When you sign up for pet insurance, you may be prompted to select a deductible amount or a deductible amount may be set by the insurance provider. This can typically range from a few hundred dollars to a higher amount, depending on your policy and the insurance company.

- You take your pet to the vet: This is where you incur costs. For example, let's say your pet requires surgery and the total bill is $1,000.

- You pay the deductible: This is what you pay directly to the vet before your pet insurance kicks in. For example, if your chosen deductible is $250, you will need to pay this amount directly to the vet after the surgery.

- Insurance coverage kicks in: After satisfying your deductible, your pet insurance will start covering eligible expenses according to the terms of your policy.

Note that costs associated with veterinary care and other pet-related expenses excluded from your pet insurance policy will not be applied toward your deductible. This includes expenses like regular wellness check-ups and grooming, which are not considered eligible under most policies.

Why Opt for a Smaller (or Larger) Deductible?

Most pet insurance companies will offer pet parents multiple deductible options to choose from. Your pet insurance deductible is one of several factors used to calculate your premium costs.

Here are a few things to consider when it comes to calculating your premium:

- Choosing a higher deductible means you’ll have a lower premium because you are choosing to cover a larger portion of your expenses out of pocket each year

- Choosing a lower deductible means you’ll have a higher premium because the insurance company will be covering a larger portion of your expenses each year

Furkin Age-Based Annual Deductible Options

As pets age, the risk factors causing various illnesses increase. One solution to offset the increased risk and increased likelihood of larger claims with age is to simply raise the premium.

While most pet insurance providers have this "birthday pricing," where the monthly premium increases as the pet ages, Furkin uses Age-Based Annual Deductibles to help keep premiums low over the course of your pet's lifetime. The chart below outlines the three different annual deductible options you can choose from depending on the age of your pet. As your pet ages, they will move into that next bracket of deductible options, which helps keep your premiums lower over time.

| Pet Age (Yrs) | Dogs | Cats | ||||

|---|---|---|---|---|---|---|

| A | B | C | A | B | C | |

| < 5 | $100 | $300 | $750 | $100 | $300 | $750 |

| 5 - 10 | $300 | $500 | $950 | $200 | $400 | $850 |

| > 10 | $500 | $700 | $1150 | $300 | $500 | $950 |

Choosing the Right Pet Insurance Deductible for You

As mentioned earlier, your choice of deductible has an impact on how much your monthly premium will cost.

If it’s helpful for your budget to have a lesser out-of-pocket responsibility throughout your pet’s life, you may choose to pay a slightly higher monthly premium for a lower deductible. However, if you’re looking to lower your monthly premium cost, choosing a higher deductible is a good option.

Factors to Consider

Choosing the right pet insurance deductible is a crucial decision that can impact your finances and your pet's healthcare.

To make an informed choice, consider the following factors:

- Budget and Financial Situation: Evaluate your current financial stability and the amount you can comfortably afford to pay out of pocket for veterinary expenses. A higher deductible can lead to lower premiums but requires a larger upfront payment if your pet needs care.

- Pet's Health and Age: Consider your pet's age, breed, and overall health. Younger and healthier pets may require fewer vet visits, making a higher deductible more feasible. Older pets or those with pre-existing conditions might benefit from a lower deductible.

- Expected Veterinary Costs: Assess your pet's healthcare needs based on its breed, history, and any pre-existing conditions. Estimate the potential annual veterinary expenses, including routine care and potential emergencies.

- Risk Tolerance: Determine your risk tolerance level. A high deductible means you'll pay more upfront, which might be acceptable if you're comfortable with the risk and want lower premiums. A lower deductible provides more immediate coverage in that your deductible will be met sooner (and, therefore, eligible claims paid out sooner) but comes with higher premiums.

- Coverage Preferences: Review the specific coverage options offered by insurance providers. Some plans may offer different deductible options for accident and illness coverage, allowing you to tailor your deductible to different needs.

Remember that there is no one-size-fits-all answer when it comes to choosing a pet insurance deductible. It's a personal decision that should align with your financial capabilities and your pet's unique healthcare requirements. Take your time to research, compare options, and consult with insurance providers to find the deductible that best suits your situation and provides the right balance between cost and coverage.

With Furkin, you can increase your deductible at any time and have the option to decrease your deductible each year when renewing your policy.

Types of Pet Insurance Deductibles

Insurers typically provide pet owners with two primary types of deductibles: annual deductibles and per-incident deductibles.

Annual Deductible

An annual deductible means you have a single deductible each policy year. Once your eligible claims have exceeded your deductible, the insurance policy will begin reimbursing you for claims for the remainder of your policy year. With annual deductibles, your deductible will reset each year upon renewal.

Furkin Pet Insurance uses annual deductibles because they are easier to understand and more predictable, allowing pet parents to better budget for their pet’s health care.

How Annual Pet Insurance Deductibles Work

Let’s say you enroll in a pet insurance policy with a $100 annual deductible. This means that you're responsible for paying the first $100 of eligible veterinary expenses each policy year before your insurance coverage kicks in.

Let’s break it down:

- Vet visit #1: A few months into your policy (let’s say, Month 3), your pet gets diagnosed with diabetes resulting in a $750 veterinary bill that insurance deems eligible for coverage.

You are responsible for paying the first $100 (your deductible). The remaining $650 is then eligible for coverage by the insurance company based on your policy’s terms and conditions and reimbursement percentage. - Vet visit #2: Oh no! A couple of months later (let’s say, Month 5), your pet has itchy paws and is diagnosed with allergies, resulting in a $400 veterinary bill.

Because you have already satisfied your annual deductible with that first vet visit, the whole $400 vet bill is eligible for coverage. You are then only responsible for your co-insurance (for instance, if you have an 80% reimbursement level with your provider, you would be responsible for 20%) - Your pet has any other visits – whether new conditions or previous eligible conditions – during the rest of the policy year.

Your deductible was already satisfied from the initial diabetes claim earlier in the year, so just like the itchy paws in month 5, any other eligible claims for your pet throughout the remainder of your annual policy year are fully covered with no impact from your deductible.

When your policy renews, one year after your enrollment date (your policy anniversary date), your annual deductible is then reset.

Note: Your deductible is not paid to the insurance company. The only amount paid to the insurance company is your monthly premium. The deductible is simply the amount of expenses you need to pay for out of pocket for eligible expenses before your insurance coverage kicks in. If you have no claims in a given policy year, then no deductible is paid by you.

At Furkin, we keep things simple with annual deductibles, making it easier to plan for vet visits.

Loving your pet is easy – and so should your pet insurance deductible! That’s why Furkin uses one annual deductible.

.png?width=6912&height=192&name=Untitled%20design%20(32).png)

How Furkin’s annual deductible works

-png.png?width=134&height=146&name=Untitled%20design%20(27)-png.png) |

You pay your set deductible once a year, and Furkin covers the rest of the eligible bills for the rest of the year—awesome, right?

Let’s say you have a $100 annual deductible and your furry friend racks up a $750 bill at the vet in eligible expenses. With a $100 deductible, you’d pay the first $100 (your deductible), and then your insurance provider swoops in to cover the rest for eligible expenses. For any future eligible vet visits that year, you're covered! |

And don't worry—deductibles aren’t payments to Furkin, just your share before we jump in to help!

Per-Condition (or Per-Incident) Deductible

A per-condition deductible means you'll have a deductible applied each time your pet has a new (different) condition.

How Per-Condition Deductibles Work

Similar to the example above, let’s say you enroll in a pet insurance policy but with a $100 per-condition deductible. This means that you're responsible for paying the first $100 of eligible veterinary expenses for each new condition before your insurance coverage kicks in for that condition. |

Let’s break it down:

- Vet visit #1: A few months into your policy (let’s say, Month 3), your pet gets diagnosed with diabetes resulting in a $750 veterinary bill that insurance deems eligible for coverage.

You are responsible for paying the first $100 (your deductible). The remaining $650 of eligible expenses is then eligible for coverage by the insurance company based on your policy’s terms and conditions and reimbursement percentage. - Vet visit #2: Oh no! A couple of months later (let’s say, Month 5), your pet has itchy paws and is diagnosed with allergies, resulting in a $400 veterinary bill.

Because this is a new condition unrelated to diabetes, you again have to cover the first $100. The remaining $300 is covered by the insurance company based on your policy’s reimbursement percentage. - Your pet has any other visits – whether new conditions or previous eligible conditions – during any policy year.

For any future claims related to diabetes or allergies, you would have no deductible applied because you already covered it previously. However, for any future claims related to other new conditions (broken limbs, cancer, etc.), your $100 deductible would have to be covered on each different condition just as it was on the diabetes and allergy examples above.

Deductibles vs. Reimbursement Percentage

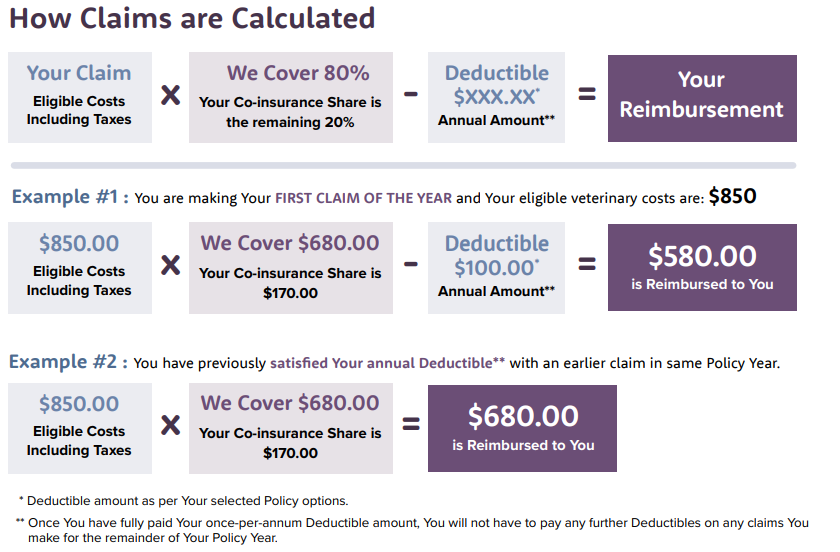

It’s important to understand the difference between deductibles, reimbursement percentages, and co-insurance. All are related to costs that the policyholder is responsible for paying out of pocket, however, it’s helpful to understand how they interact when calculating the amount an insurance company reimburses for each of your veterinary expenses.

With Furkin Pet Insurance, your reimbursement percentage is applied first and you pay a portion (co-insurance) of your total eligible veterinary or care expenses. You are then reimbursed the balance of these expenses after your annual deductible has been paid.

For example, let’s say you have a $100 annual deductible, an 80% reimbursement rate, and a 20% co-insurance amount:

- First Claim: You submit your first eligible claim of the policy year for $1,000, your reimbursement percentage is 80% which comes out to $800, then your annual deductible is applied so you would be reimbursed $700.

- Second Claim: Your second eligible claim of the policy year is $2,000, your reimbursement percentage is 80% which comes out to $1,600. Because you have an annual deductible that was already covered on your first claim, you would be reimbursed the full $1,600.

Do All Claims Apply to a Pet Insurance Deductible?

A pet insurance deductible is only applied toward eligible claims. Read your pet insurance policy carefully to understand which services are eligible versus ineligible for reimbursement.

Ineligible Expenses

For example, a standard accident and illness pet insurance policy will not cover services related to preventive care or pre-existing conditions.

- Annual wellness checkups

- Vaccinations

- Preventive medication for flea & tick or heartworm

- Expenses related to pre-existing conditions

- Any claims occurring during your policy waiting periods

For these ineligible items, the deductible does not apply since the policyholder has full responsibility for these expenses.

Exclusive Benefits

Some pet insurance companies may include additional benefits in your coverage that will be fully reimbursed with no deductible applied.

For example, Furkin Pet Insurance comes with over $4,000 of added pet owner assistance benefits including:

- Boarding fees up to $1,000

- Holiday/trip cancellation cost up to $1,000

- Advertising & reward up to $1,000 for a lost or stolen pet

- Cremation and/or burial costs up to $1,000 if you Veterinarian recommends your pet be medically euthanized

- 24/7 Telehealth and more

For these added benefits, your deductible and reimbursement percentage do not apply, so you will receive full reimbursement for these eligible situations. See the Furkin Sample Policy for full details.

Are There Pet Insurance Policies With No Deductible?

Yes, there are some (very few) pet insurance policies that offer a zero-deductible option. These policies are designed to provide coverage without requiring pet owners to meet a deductible before the insurance company begins reimbursing eligible expenses. However, these policies come with a much higher premium than other pet insurance policies.

Explore Flexible Pet Insurance Deductibles with Furkin

In the quest to safeguard our furry companions' health and happiness, choosing the right pet insurance deductible plays a pivotal role. Whether you opt for a high deductible to lower premiums or a low deductible for lower out-of-pocket costs, the decision will depend on your unique needs, your pet's health, and your budget.

At Furkin, we understand that your pet is more than just a companion; they're family. That's why we offer a range of flexible pet insurance options to suit your preferences and financial situation.

So why wait? Check out Furkin's Pet Insurance options today and give your furry friend the protection they deserve.